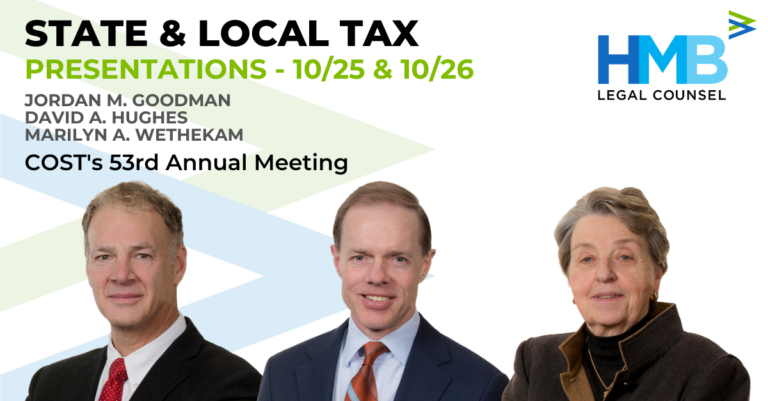

Join Jordan M. Goodman and David A. Hughes for the Council on State Taxation’s (COST) 53rd Annual Meeting in Orlando, Florida. See below for more information on their presentations.

Early Morning Ethics Coffee Talk – Ethical & Professional Challenges Facing State Tax Professionals

Jordan M. Goodman | 10/26/22 at 7:00 – 8:00 AM

Rise and shine and enjoy an entertaining, informative hour on the latest ethics developments relevant to state tax professionals. This presentation will serve as your “wake up” for Tuesday morning. However, there’s much more to this session than getting an hour of Ethics CPE/CLE. Tax professionals and government affairs professionals must navigate a host of ethical issues on a daily basis. Some issues are obvious, others may not be. Jordan and his co-presenter Sara Arvold will discuss how to spot ethical issues and deal with them in a thoughtful and effective manner.

Tax Policy Implications: Income Tax vs. Sales Tax vs. Excise Taxes

David A. Hughes | 10/26/22 at 1:40 – 2:30 PM

How states obtain revenue has come under more intense scrutiny due to the COVID-19 pandemic. State governments are evaluating the trade-offs associated with different tax revenue sources to decide how to best fund growing expenses while limiting taxpayer burdens in a difficult economy. Individual income tax and sales tax remain heavily relied on while excise taxes, such as taxes on recreational marijuana, sports betting, and sweetened beverages, may have a growing allure since they are narrowly imposed and often on products generally considered harmful.

In this panel discussion, David and his co-speakers will “hash” out the merits of different revenue sources, give state examples that have succeeded as well as those that have failed, and share the latest state policy proposals.